Zenith Minerals Strengthens Position in Western Australian Gold Play with Strategic Land Acquisition

Zenith Minerals has significantly boosted its exploration momentum by acquiring a crucial neighbouring mining lease next to its Consolidated Dulcie gold project in Western Australia. This strategic move follows closely on the heels of a substantial resource upgrade announced just yesterday, which increased the project's estimated gold resources to 675,000 ounces grading one gram per tonne (g/t) gold.

Key Details of the Mining Lease Acquisition

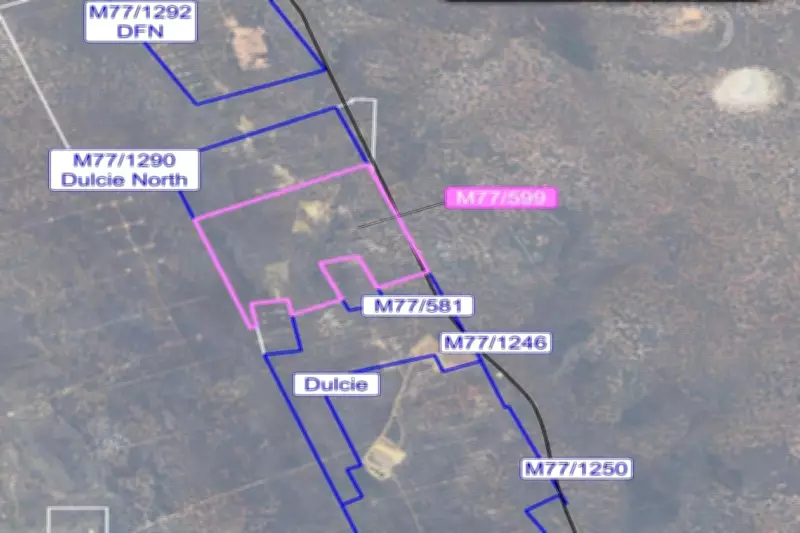

The newly secured Mining Lease M77/599 is situated adjacent to Zenith's existing Dulcie Far North deposit, which holds 300,000 ounces of gold, as well as the recently categorised Dulcie and Dulcie North deposits to the south. These southern deposits collectively contain 375,000 ounces of inferred gold resources. The acquisition provides Zenith with an additional six kilometres of gold-bearing strike length, directly in line with the company's current grounds.

This lease acquisition comes at a cost of $1.5 million in cash, including a $50,000 non-refundable deposit. Additionally, the agreement includes a two per cent net smelter return royalty over minerals produced from the tenement once commercial production commences.

Geological Significance and Strategic Advantages

The newly acquired lease occupies a central position within Dulcie's emerging geology. Zenith Minerals believes the mineralisation is forming a textbook stacked lode system, with more than ten individual gold lodes identified within a broad, gently dipping shear zone. Rather than consisting of a single narrow vein, the gold is distributed across multiple sub-parallel horizons, providing the project with both scale and continuity.

This style of mineralisation is particularly well-suited to open-pit mining methods, as many of the lodes are located close to the surface and remain open along strike and down dip. The timing of this acquisition is particularly advantageous, as it simplifies boundary complexities following the recent resource consolidation and adds valuable flexibility as the company evaluates staged open-pit mining and potential toll-treatment pathways.

Management Perspective and Future Development

Zenith Minerals Managing Director Andrew Smith commented on the acquisition, stating: "Securing M77/599 is a logical and disciplined step in consolidating our position within the broader gold system. M77/599 carries legacy royalty arrangements, which are well understood and have been incorporated into our development assessment."

The Dulcie project benefits from its proximity to established processing hubs, including the Marvel Loch processing plant, which is within trucking distance. This location provides Zenith with multiple low-capital expenditure pathways should the company decide to advance toward production. In today's market environment, such optionality is particularly valuable for junior mining companies, as investors increasingly reward projects that can be brought online quickly and cost-effectively.

Next Steps and Market Context

The upcoming steps for Zenith Minerals are largely procedural, involving ministerial approvals and royalty-related conditions that must be satisfied before settlement can be completed. Once these formalities are finalised, Zenith will emerge with a cleaner, more cohesive land position over one of its most advanced gold assets.

This strategic consolidation comes at an opportune moment, with gold prices hovering near record highs and growing investor appetite for capital-light development stories. As scoping studies progress and development options become clearer, Zenith's methodical approach to land consolidation may well be laying the groundwork for Dulcie's evolution into a genuine Western Australian gold development contender.