Billionaire Investor Quietly Accumulates Venus Metals Shares

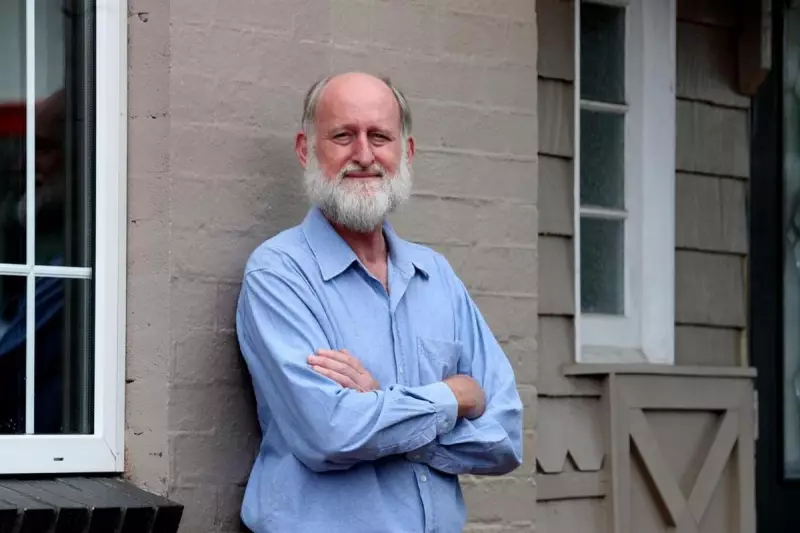

In a strategic move that's caught the attention of Australian mining investors, billionaire Chris Wallin has significantly increased his stake in Venus Metals Corporation. The QCoal Group founder has lifted his holding to 26.21 per cent, well above the standard takeover threshold of 19.9 per cent.

Wallin, ranked number 50 on The Australian's 250 Rich list with an estimated fortune of $3.13 billion, built QCoal from scratch into a five-mine operation generating approximately $400 million annually in dividends alone. His latest acquisition of 3.59 million Venus shares brings his total holding to more than 51 million shares.

Strategic Positioning in Gold Sector

The timing of Wallin's increased investment coincides with significant developments at Venus Metals' key asset exposure. The company holds substantial interest in Rox Mining's 2.2-million-ounce Youanmi gold project in the Murchison region, including both a significant shareholding in Rox and a valuable royalty over future production.

Recent developments have substantially increased the project's momentum. Rox has secured a substantial $200 million placement that will fully fund project capital expenditure, underground development, drilling programs and working capital at Youanmi. This funding puts the schedule on track for a final investment decision and first gold production by mid-2027.

Venus Metals originally sold its Youanmi stake to Rox two years ago in exchange for 110 million Rox shares. Half of these were distributed to Venus shareholders, giving Wallin an initial 2.4 per cent position in Rox that he has since built to 8.5 per cent. The remaining 55 million Rox shares on Venus' books are currently valued at $21.2 million, despite Venus' total market capitalisation trading at just $31 million.

Royalty Assets and Exploration Upside

Beyond its shareholding, Venus holds a potentially game-changing asset in the form of a one per cent net smelt royalty over future production at Youanmi. This royalty was independently valued at $25.4 million in October using a conservative gold price of A$5500 per ounce.

With gold currently trading around A$6000 per ounce, this royalty could generate substantial cash flows for Venus in the coming years. The company's market capitalisation appears almost justified by this royalty and its Rox shareholding alone, without accounting for its own exploration projects.

Venus is actively developing its Sandstone project, located just 70 kilometres from Youanmi, where it's fast-tracking development at the Bellchambers deposit containing a 30,800-ounce resource. The company is pursuing a new mining lease application and potential mine-gate arrangement with Rox.

Additional exploration at the Pincher project, only 15 kilometres from Youanmi, has revealed a substantial VMS system with strong zinc and indium hits. The company's partnership with IGO at the Bridgetown lithium project adds further credibility, with IGO recently committing to increase its stake to 70 per cent.

Wallin's continued investment, executed under the Corporations Act's 'creep' provision allowing 3 per cent increases every six months, signals strong confidence in Venus Metals' prospects as the Youanmi project moves closer to production.