Wollongong Fraudster Escapes Custodial Sentence After Complying with House Arrest

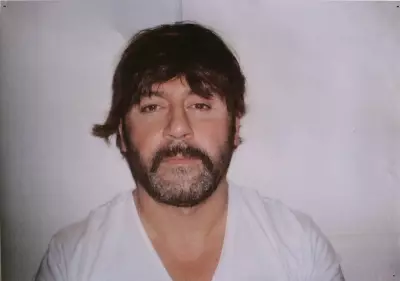

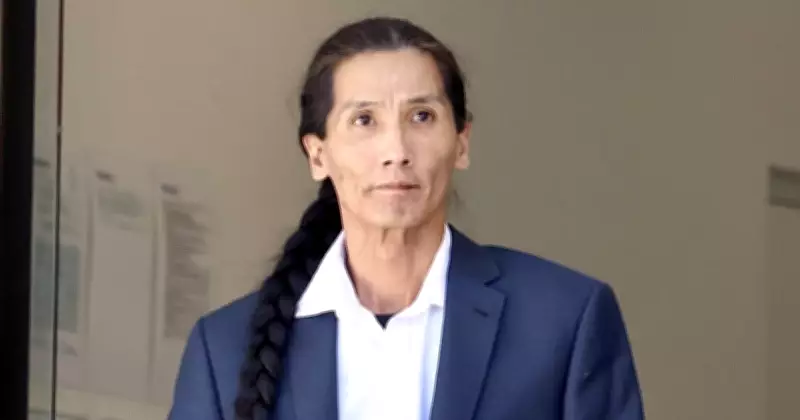

In a notable decision at Wollongong Local Court, a man involved in a sophisticated banking scam has managed to avoid a jail cell, largely due to his adherence to strict home detention conditions over the past fifteen months. Chi Huynh, aged 42, pleaded guilty to dishonestly obtaining financial advantage by deception, relating to his participation in a fraudulent syndicate that targeted the National Australia Bank.

Details of the Elaborate Scam Operation

Court documents unveiled that the criminal operation began to unravel in August 2024 when NAB initiated an investigation. The syndicate, which included two other individuals—Nenad Radovanovic, 44, and Daniel Mantovani, 34—had been creating counterfeit business profiles to acquire merchant terminals. These terminals were then utilised to manually process illicit payments using compromised or stolen credit card details.

Huynh's specific involvement entailed applying for a NAB terminal and operating it from his residence to facilitate the fraudulent transactions. Subsequently, he distributed the illicitly obtained funds to various other accounts. In total, his actions resulted in a theft of $45,000 from the bank before law enforcement arrested him on October 23, 2024.

Sentencing Arguments and Judicial Outcome

During the sentencing proceedings, Huynh's legal representative, Ben Hart, portrayed his client as a "model citizen" who had meticulously complied with his house arrest conditions since being charged. Hart emphasised that Huynh had been actively addressing a heroin addiction, which he identified as the underlying cause of the criminal behaviour. Additionally, it was submitted that Huynh had repaid $25,000 of the stolen amount.

Conversely, the Crown prosecutor advocated for a custodial sentence, highlighting the seriousness of the fraud and noting that NAB had not yet received any restitution from Huynh. Despite these arguments, Magistrate David Williams ultimately sided with the defence, influenced by Huynh's unwavering compliance with what he described as "quasi-custody" while on bail.

Magistrate Williams remarked, "Were it not for that, I would have sent him to full-time jail. This was a very substantial and significant criminal operation for the systemic defrauding of the National Australia Bank. It is an offence against the entire community."

Final Penalties Imposed

As a result, Huynh received a 10-month intensive correction order, which is a community-based alternative to imprisonment. He was also mandated to complete 100 hours of unpaid community service work. This sentencing outcome underscores the court's consideration of rehabilitation efforts and compliance with bail conditions, even in cases involving substantial financial crimes.