Treasurer Jim Chalmers has firmly rejected accusations that his government's spending is exacerbating inflation, as millions of Australians anxiously await a potential interest rate increase later today. The Reserve Bank of Australia is poised to deliver its first rate decision of the year, with economists widely forecasting a 25 basis point hike. This would mark the first rise in over two years, placing additional strain on households already grappling with cost-of-living pressures.

Political Debate Over 'Jimflation' Intensifies

The looming prospect of higher interest rates has ignited a fierce political debate, with critics coining the term "Jimflation" to blame the Treasurer for allegedly fuelling price pressures through sustained government expenditure. On Sunrise this Tuesday, Chalmers countered these claims by pointing to alternative factors driving the recent uptick in inflation.

"There's not a unanimous view amongst the economists about what's driving the most recent tick up in inflation," Chalmers stated. "If you look at the facts, that tick up in the most recent data was largely about holiday spending, the withdrawal of the energy rebates, and some more persistent issues in housing."

Government's Response to Inflation Challenges

The Treasurer acknowledged that inflation continues to pose a significant challenge for Australian households, but emphasised that the government is actively responding with targeted relief measures while simultaneously working to repair the budget.

"There's some temporary issues, some permanent or persistent issues, when it comes to our inflation challenge," he explained. "We acknowledge that we've got this challenge in our economy. We know that people are under pressure, we more than acknowledge that, we're rolling out cost-of-living help, we're repairing the budget because we know that even though the budget is not the primary determinant of prices in our economy, governments can play a helpful role, and that's our focus."

Comparing Australia's Economic Position Globally

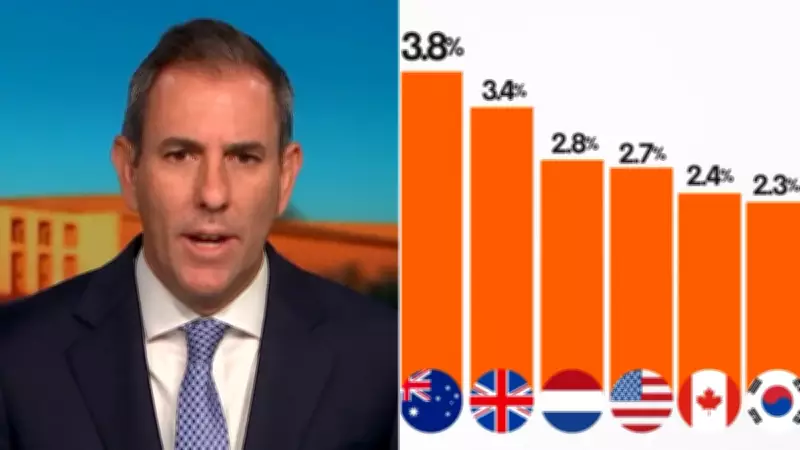

While Australia's inflation rate currently exceeds that of major economies such as the United Kingdom, United States, Germany, Japan, Canada, and France, Chalmers urged a broader consideration of the nation's overall economic conditions.

"You've got to make the whole comparison," he argued. "We've got lower unemployment than most of those countries. We've got faster economic growth than all of those countries except for the US. We've got a much better budget than those countries in the G7."

Chalmers also reaffirmed his previous stance that the peak of inflation has passed, despite renewed pressures on mortgage holders. "The worst of the inflation challenge was in 2022," he noted. "We came to office, inflation had a six in front of it and was absolutely galloping. That's not to dismiss the very real pressures that people are confronting right now."

Economists Predict Limited Options for RBA

Despite the Treasurer's insistence that government policy is not the primary driver of inflation, economists believe the Reserve Bank has minimal room to manoeuvre. HSBC chief economist Paul Bloxham, speaking on Sunrise, indicated that rising inflation has left the RBA with few alternatives but to increase interest rates.

"I think the RBA will be lifting its cash rate today by 25 basis points," Bloxham predicted. "I don't think there are a lot of options here. Inflation has risen, it's surprised them to the upside, it's above their target."

Bloxham highlighted that the economy remains in an upswing, with a tight labour market complicating efforts to cool inflation without monetary tightening. "It's hard to see inflation coming down enough without the RBA putting the foot on the brakes a little bit," he added.

Implications for Mortgage Holders and Home Buyers

The anticipated rate hike is expected to impact millions of mortgage holders and prospective home buyers across Australia. The Reserve Bank of Australia's decision, which will be announced at 2:30pm today, represents a critical moment for the nation's economic trajectory amid ongoing debates about fiscal responsibility and monetary policy.